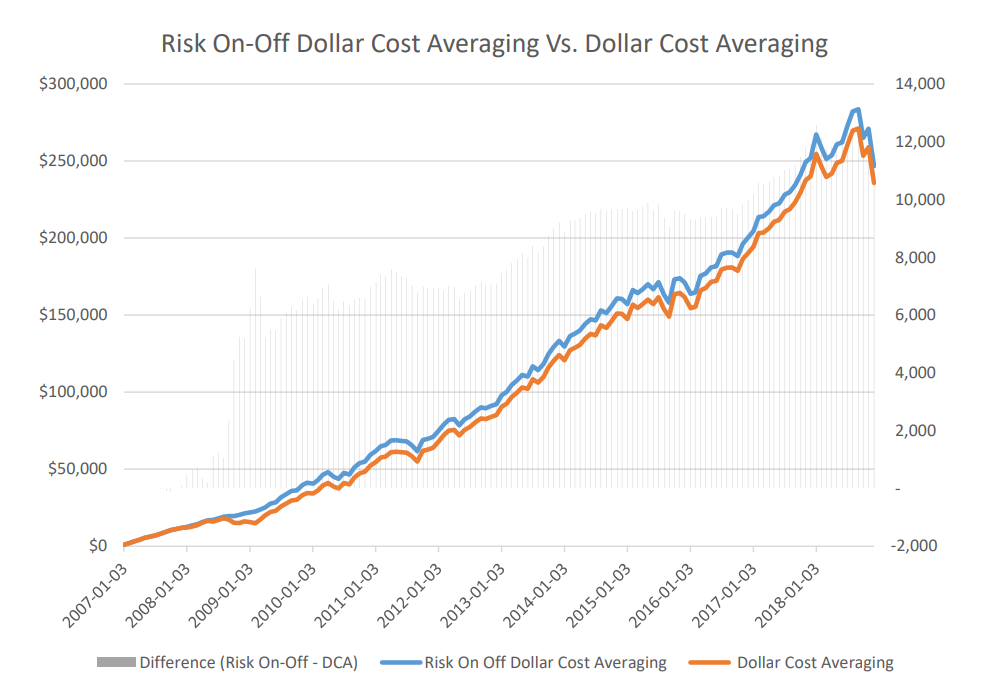

Market Timing

There is a lot of literature on this subject and many strongly held opinions, mostly against it. But any “opinion” should always be backed up by facts. Otherwise you might as well be selling snake oil or be a high priest. What do people who rail against market timing really mean?

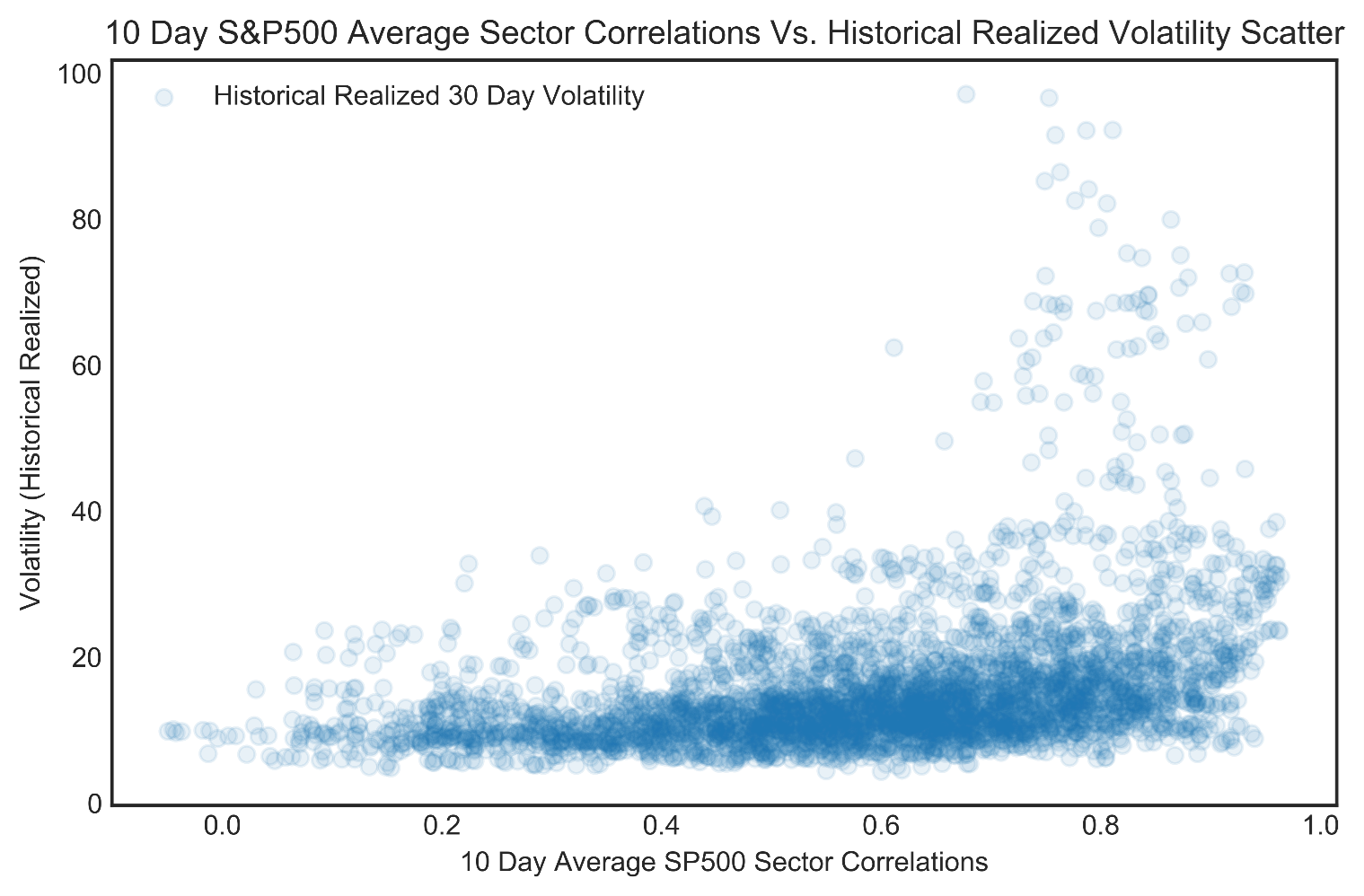

Using Correlations and Volatility to Classify Market Risk Regimes

We explore how to use correlations and volatility to determine market risk and return profiles. To do this, we focus on US SP500 Sector Correlations, showing that low correlation regimes exhibit low volatility, while high correlation regimes exhibit high volatility. First, we provide background on why we believe Correlations are important and what this tells us about investor behavior.